The Rise of Multi-generational Living: Mortgage Solutions for Today’s Housing

April Gould, February 12, 2025

With the skyrocketing costs of housing, groceries and most goods and services, more families are pooling resources to afford a single household.

The way families live together is evolving, and multi-generational households are becoming more common than ever. According to Pew Research, the number of multi-generational homes in the U.S. quadrupled from 1971 to 2021. In the early 1970s, just 7% of Americans lived in multi-generational homes. By 2021, that percentage increased to 18%, equating to nearly 1 of every 5 Americans.

More families are choosing to live under one roof, whether to support aging parents, provide a stable foundation for young adults, or to share financial responsibilities. As this trend grows, so does the need for mortgage solutions that accommodate larger living spaces and renovations.

Factors Fueling This Trend

Several factors are contributing to the increase in multi-generational living, such as the economy, the aging population, and societal influences.

Cost of living

With the skyrocketing costs of housing, groceries and most goods and services, more families are pooling resources to afford a single household.

In a recent article by Susan Wachter, a Wharton professor of real estate and finance, Millennials and Gen Z face struggle with rising housing costs despite higher salaries. According to Wachter, housing expenses once accounted for 25% of income but now approach 40%. Coupled with student loan debt and childcare expenses, this has led younger generations to stay in multi-generational homes longer. The National Association of Realtors recently reported that the median age of a first-time homebuyer is now 38 years old, an all-time high.

Moreover, older adults, those aged 65 and older, are also feeling the pinch of the current economy. Based on the Elder Index, a tool that measures how much income is needed to achieve economic security, nearly half of older adults fall below the index value for where they live. Multi-generational living can be a financial solution that benefits both older and younger adults.

Extended lifespans

People are living longer and may be concerned about outliving their retirement funds. In a 2020 report by the US Census Bureau, it was projected that by the year 2034, older adults will outnumber children for the first time in American history.

As people live longer, healthcare costs rise, and many prefer to age in place. 25% of adults in multi-generational households cite adult caregiving as a major reason for their living arrangement.

The most recent Genworth Cost of Care survey found that the costs for an assisted living facility increased to approximately $64,200 a year and even more so for skilled nursing facilities – the national median cost of a private room in a nursing home is $116,800 a year. It’s no wonder that more families are opting to live together and provide care themselves or utilize in-home care to reduce costs.

Social Influences

Another factor contributing to the multi-generational living trend is the changes in societal influence. Today’s young adults are staying in school longer, delaying marriage, and forming their own households later.

Benefits of Multi-generational Living

While sharing expenses among multiple generations can make homeownership more attainable and provide financial security during uncertain times, the benefits of this living arrangement go beyond economics.

In a 2021 report from Generations United, 98% of those surveyed responded that their multi-generational household functions successfully. Besides the financial benefits, the top factors contributing to this success were a strengthened family bond, positive impact on physical and mental health and the opportunity for at least one family member to continue school or enroll in job training. Additionally, expanded access to high-quality child or adult care and an environmentally friendly housing option were cited.

Housing Options for Multi-generational living

Research suggests that this trend will continue, and the real estate market is starting to adapt. Single family homes with dedicated “mother-in-law” suites, duplexes, triplexes and Accessory Dwelling Units (ADUs) are all experiencing a rise in popularity.

Accessory Dwelling Units (ADUs)

An increasing number of municipalities are changing zoning laws to be more ADU-friendly and more developers are building homes with multi-generational living in mind.

An ADU is a self-contained secondary housing unit that is either connected to or within the primary residential home or a standalone home on the property. ADUs can be referred to as in-law suites, granny flats, a guest house, a casita and more. Depending on the local zoning law, the ADU may be required to have its own kitchen with a sink, a bathroom, sleeping area and separate entrance.

This type of housing can be designed with aging-in-place features to give an older adult a place to live that is safe and close by, or as a home for a young couple just starting out, or as a flex space that provides much needed additional square footage.

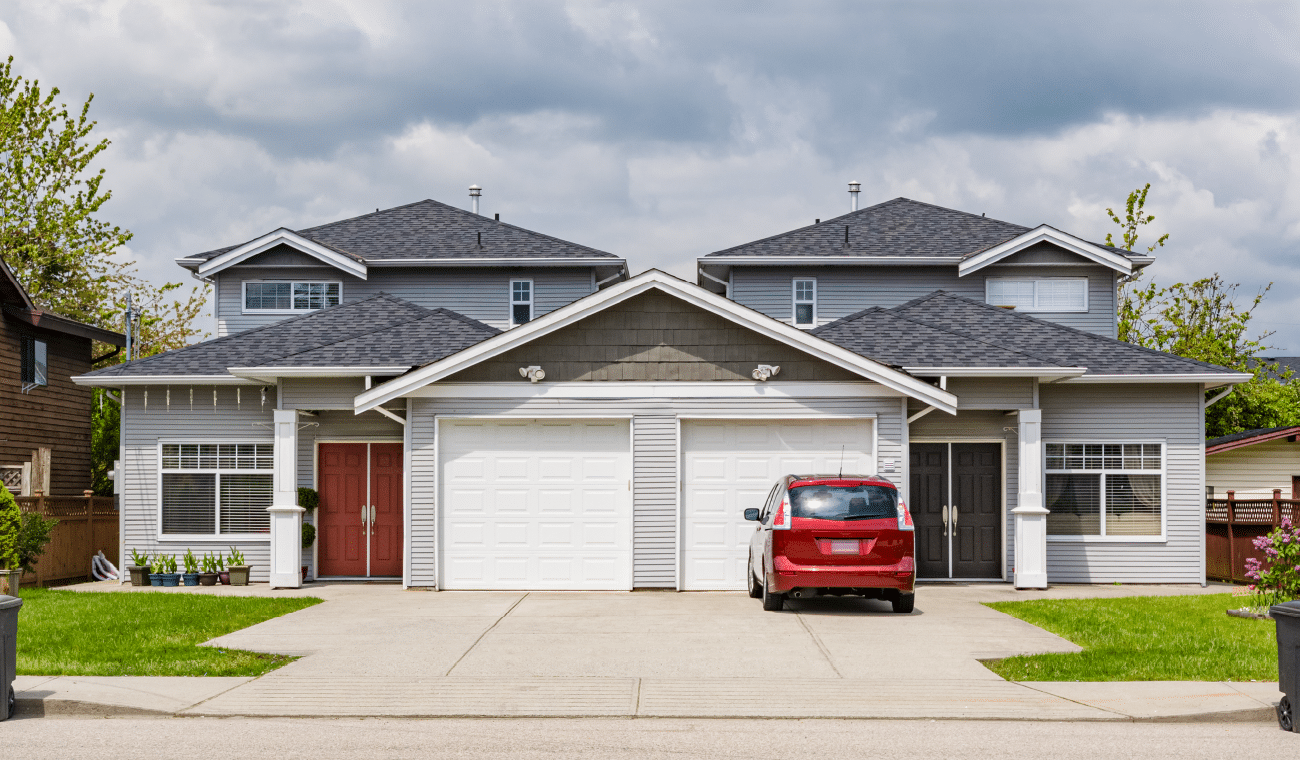

Multi-family Homes

Just as the name implies, a multi-family home is a type of residential property that allows for one or more households to live in it at the same time. Examples of this type of housing are duplexes, triplexes and quadplexes.

Owning a multi-family home can be an effective solution to rising housing costs. By living in one unit and renting out the other to family members, the homeowner can not only make ends meet but have family just a doorstep away.

Financing For Multi-generational Living

As housing needs change, mortgage options must evolve to meet them. For families looking to buy or modify a home to fit multiple generations, there are a variety of financing solutions.

Renovation Loans for Home Modifications

Renovation loans can be a good option for those who already own a home but need to make it more suitable for multiple generations, or for purchasing a fixer-upper to meet evolving needs. MiMutual Mortgage offers renovation loans that allow borrowers to combine the purchase or refinance with renovation costs into one single loan.

These loans provide flexibility to expand common areas, create independent living spaces (such as in-law suites or basement apartments), add bedrooms, install accessibility features, or even build a standalone ADU.

We offer:

FHA 203(k) Limited and Standard:

203(k) loans offer the flexibility of FHA financing with a low 3.5% down payment, making them ideal for home renovations and repairs.

Fannie Mae HomeStyle:

The HomeStyle loan offers strong conventional financing and is a good option for borrowers who want to take on larger, more customized renovations.

Freddie Mac CHOICERenovation Loan:

Similar to the HomeStyle loan, this option is available for a variety of property types including owner-occupied 1-4 units that may work well with multi-generational living. Both minor and major renovations are allowed.

Jumbo Loans for Larger Homes

Multi-generational families often require more space, which can mean purchasing a home that exceeds conventional loan limits set by the Federal Housing Finance Agency.

These loans can be ideal for families looking to buy a home with multiple bedrooms, separate living areas, or additional amenities to support multiple generations. With competitive rates and flexible terms, jumbo loans allow families to secure the space they need while keeping mortgage payments manageable. MiMutual Mortgage offers Jumbo loans with as little as 10% down and loan amounts up to $4 million.

Cash-Out Refi Loan

A cash-out refinance can be a powerful tool for creating or improving multigenerational housing by leveraging the equity in a home to fund necessary upgrades or transitions.

By tapping into equity and getting a lump sum of cash at closing, the funds can be used however the homeowner sees fit. This could include renovating for more space, modifying to include senior-friendly or child-safe features, or adding an ADU.

Loans for multi-unit housing

Multi-family homes can be an affordable way to share the costs of living and accommodate multiple generations under one roof. Historically, the biggest barrier to owning a multi-family property was the substantial down payment requirement of 15-25%. However, with rising demand for affordable housing and multigenerational living, buyers can now secure multi-unit financing with as little as 5% or less.

To take advantage of these lower down payment options, borrowers will need to live in one of the units as their primary home. 1-4 unit home financing is available with conventional loans for as little as 5% down and just 3.5% down with FHA financing. Multi-family homes in eligible rural areas can be purchased for zero down through the USDA Rural Development loan while the VA loan offers Veterans, active-duty service members, a zero down option as well.

Moving Forward

Multi-generational living isn’t just a trend—it’s a long-term shift in the housing market. With thoughtful planning and working with the right lender, families can find homes that bring generations together while providing comfort, privacy, and all the benefits this type of living provides.

If you’re considering a home that fits multiple generations, MiMutual Mortgage is here to help. Contact us to explore your mortgage options

You are about to begin the mortgage loan application

- Applying on the MiMutual Mortgage Online Loan Application is quick, easy, and secure! The loan application will take about 25 minutes to complete.

- Once your application is submitted, you can log back into the MiMutual Mortgage Online Loan Application to securely upload requested documents, view your loan status, and communicate with your mortgage team.

- If you have questions, reach out to your MiMutual Mortgage Loan Officer.

Your guided mortgage journey starts here!

Start Application