How to Lower Your Mortgage Interest Rate

April Gould, May 1, 2023

Are you thinking about buying a home soon? If so, there’s a good chance you’re also thinking about the current interest rates. Since 1971 Freddie Mac has been tracking weekly mortgage interest rates and it may be hard to conceive, but borrowers in the 1970s and 80s were paying double digit interest rates, with a record high in 1981 at 18.63%! (https://www.freddiemac.com/pmms )

Lenders understand the need for flexible financing in today’s market, and that’s why programs such as ARMS, paying Discount Points, and Temporary Interest Rate Buydowns are increasing in popularity.

Those buying in the 90’s and early to mid-2000’s saw fluctuations ranging from double to single digits. And of course, in 2020 and 2021 as a response to the pandemic, rates were kept unusually low, with the lowest 30-year fixed interest rate in history landing at 2.65% in January 2021. Overall, however, the average mortgage interest rate since 1971 is just under 8%.

But that being said, there is one big difference in today’s housing market – and that’s the average price of a home. So, while the current interest rates are not unusually high, due to the current housing costs, even small changes in the rates can significantly affect your monthly mortgage payment and the overall affordability of a home.

So, how can you lower your interest rate?

First it should be noted that factors such as a good credit score, a large down payment and a solid credit history will get you better interest rates. Therefore, before you look for a house, you should know what’s on your credit report and clear up any inaccuracies to improve your score. Also, save up as much money as you can for closing costs and a down payment.

But if having top notch credit and 20% down isn’t in the cards right now, buying a home and getting a lower interest rate is still an option for you! Lenders understand the need for flexible financing in today’s market, and that’s why programs such as ARMS, paying Discount Points, and Temporary Interest Rate Buydowns are increasing in popularity.

ARMS, Paying Discount Points and Buydowns…what’s the difference?

ARM stands for Adjustable-Rate Mortgage. And just as the name implies, the interest rate and monthly payment periodically adjusts throughout the life of the loan. The benefit is that initially, your interest rate and payment will be much lower before the adjustment. This option may be appealing for those borrowers that do not intend to stay in their home long term, say 5 years or less or for those who plan on refinancing to a fixed rate in the future.

Paying Discount Points is a permanent way to lower your interest rate. A mortgage point equals 1 percent of your total loan amount. For example, on a $300,000 loan, one point would equal $3,000. When a mortgage point is used to lower your interest rate it is known as a discount point.

So, when you pay points, you are essentially pre-paying the interest in exchange for a lower interest rate and monthly payment. This typically results in an interest rate reduction ranging anywhere from 0.125 percent to 0.5 percent per point and lasts the life of the loan. The more points you pay, the greater reduction in interest and the lower your monthly payment. With this option, you pay more up front at closing, in order to save money in the long run. This may be a good option for those that plan on staying in their home long enough to reach the breakeven point.

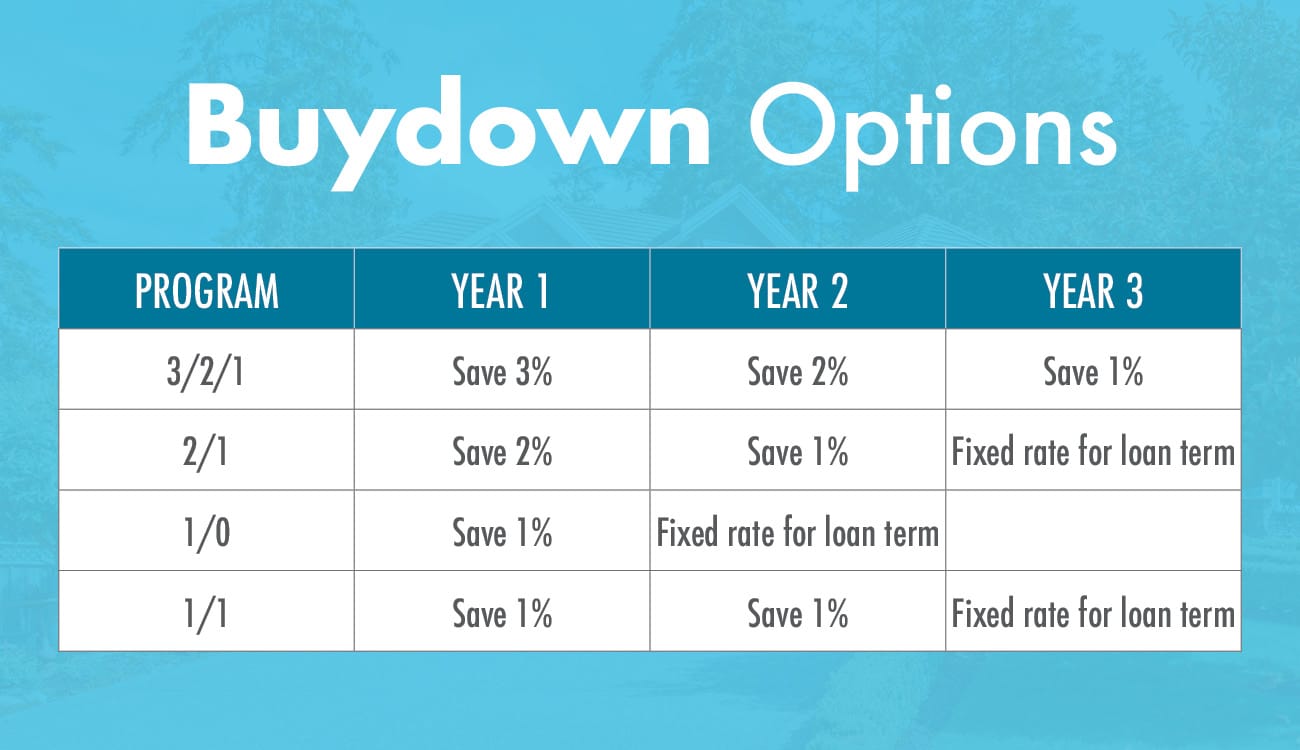

Temporary Interest Rate Buydowns are a popular option because unlike ARMS, your rate and monthly mortgage payments are fixed, and not subject to fluctuations. A Temporary Interest Rate Buydown is a financing tool that allows well-qualified borrowers – who are qualified at the full Note rate – to reduce their interest rate and monthly payment during the early years of the mortgage. A lump sum of money is deposited up front into an escrow account and temporarily reduces the interest rate and monthly mortgage payment for a specific period of time. The monthly mortgage payment is made from the buydown funds in the escrow account in conjunction with your reduced monthly payments and increase annually until the end of the buydown period.

The borrower has the option of a 3-year, 2-year or 1-year reduction period. Once the initial reduction is over, the interest rate remains at a fixed rate for the life of the loan.

If you were to pay off the mortgage before all the buydown funds have been depleted, the remaining funds in the account would get applied to the balance owed and result in a reduced payoff.

This is important to remember so that if and when rates improve, you can take advantage of refinancing to a permanent lower interest rate, and the funds remaining in your buydown account are available to reduce the amount you owe.

The funds for the buydown escrow account can be funded by either the seller through seller concessions, or by the lender with a pricing adjustment. This allows you to save between 1% and 3% off the interest rate without having to pay out-of-pocket at closing.

Seller funded Temporary Interest Rate Buydowns

The seller can buy down the buyer’s rate through what’s known as a seller concession. Seller concessions are closing costs that the seller agrees to pay at closing on behalf of the buyer to help make the sale. Offering concessions can be mutually beneficial because it may be more cost effective for a seller to pay concessions than it is to lower their asking price.

Lender funded Temporary Interest Rate Buydowns

In a market that tends to favor sellers, and one in which the demand for housing is strong, it may be harder to for a buyer to receive seller concessions. That’s where MiMutual Mortgage’s lender funded Buydown is a great option!

Our lender funded buydown programs allow the cost of the buydown to be built into the pricing. This means, no seller concessions needed and no money out of pocket for the borrower at closing.

As you can see, there are many options available to give borrowers a little breathing room when it comes to interest rates. If you need help to decipher what may work best for your situation, speak to one of our experienced Loan Officers and start your journey to homeownership!

You are about to begin the mortgage loan application

- Applying on the MiMutual Mortgage Online Loan Application is quick, easy, and secure! The loan application will take about 25 minutes to complete.

- Once your application is submitted, you can log back into the MiMutual Mortgage Online Loan Application to securely upload requested documents, view your loan status, and communicate with your mortgage team.

- If you have questions, reach out to your MiMutual Mortgage Loan Officer.

Your guided mortgage journey starts here!

Start Application